In the world of digital and speedy-paced things today Banking online has become very important in our financial existence. The most secure and convenient online banking for members at Seacomm Federal Credit Union (a trusted financial institution) is known as Seacomm Netteller. This guide will provide all the information that you need concerning Seacomm Netteller starting from making an account up to your finance management.

What is Seacomm Netteller?

The Seacomm Netteller that you speak of is an initiative of Seacomm Federal Credit Union to help its members do online banking. This makes it possible for those who do so from all over the world in different time zones. This application enables users to view their current account balances, check transaction history, and make payments among others.

Benefits of Using Seacomm Netteller

Many advantages come with the use of Seacomm Netteller Login which makes handling finances easier for all individuals in question:

- Access the account any time on any day

- Account update immediately after being requested

- Transfer funds from one account to another conveniently

- Bill payment options available

- Mobile banking provided for clients

- Secured through several layers technology-wise

- No more long papers carrying a lot of documents or letters

- Enable customized alerts and messages hence serve as reminders or updates

- Can be processed in a few steps without struggle

- Saving time is a priority for everyone

You can take charge of your expenditure and know how best to manage it regardless of the time if you utilize these benefits above.

How to Set Up Your Seacomm Netteller Account

It is easy to create your Seacomm Netteller account:

- Go to the Seacomm Federal Credit Union website https://www.seacomm.org/.

- Search for the section titled “Online Banking” or “Netteller”.

- Press on the “Enroll Now” or “Sign Up” button.

- Fill in your details: member number, social security number, and date of birth.

- Choose any username that you will remember easily and make a strong password.

- Establish security questions and answers for extra safety.

- Read through and accept the terms and conditions.

- Confirm your identity using one out of several safe methods (ex: email or phone).

- Finish enrolling.

After setting up your account, you will be able to utilize all resources available through the Seacomm Netteller platform.

Read Also: Baltimore Gas and Electric Login: A Comprehensive Guide

Logging In to Seacomm Netteller

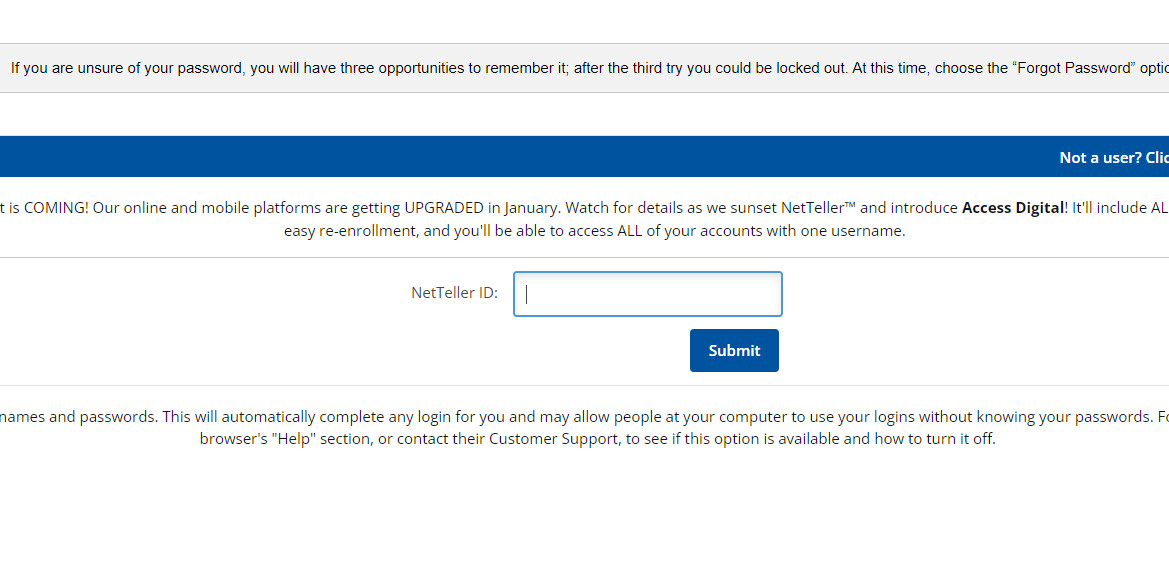

The first step simply and securely approach your Seacomm Netteller Login account:

- Visit the Seacomm Federal Credit Union site https://www.seacomm.org/.

- Find the site’s Benutzeranmeldung leave in the right upper corner.

- Then, write down your proper name beneath the user name.

- Also, let’s be careful to enter passwords accurately.

- Before moving on proceed by clicking on either “Login” or “Sign In”.

- Finally, there may be some extra steps of verification (like entering a temporary key or answering questions).

Make sure that you maintain secrecy over login details and do not use public computers or unsecured Wi-Fi networks when approaching your account.

Navigating the Seacomm Netteller Dashboard

The Seacomm Netteller dashboard is delivered to you as soon as you log in successfully. The dashboard is a central point for all your bank accounts and gives you easy access to all banking features. Common elements that feature on the dashboard include:

- Account summaries and balances

- Quick links to common tasks (transfers, bill pay, etc.)

- Recent transaction history

- Alerts and notifications

- Menu options for accessing different services

Take time to know how it is structured and what is available so that you can enjoy online banking effectively.

Managing Your Accounts

Seacomm Netteller has an assortment of instruments meant to make account management possible:

- Find out the balances and transactions you have made

- Get access to account statements by downloading them

- Search for particular transactions

- Classify your spending for the budget

- Create and simulate goals for savings

- Seek loans or credit cards

- Request new checks or replace missing debit cards

Through reviewing your accounts often, one can give themselves control over their finances and also note if there are any differences in these figures thus making it easy to identify odd activities.

Making Transfers and Payments

Amazingly, the fantastic Seacomm Netteller can help you easily move your money and also pay your bills. This is how you can do it with ease:

Internal Transfers

- Go to the transfer or move money page.

- Choose your source and target accounts respectively.

- Input the transfer amount as well as the date.

- Check through the information provided before finally verifying it.

External Transfers

- Establish and validate outside accounts (might necessitate minute deposits).

- Pick the “Outer Transfer” choice.

- Choose the origin and destination accounts.

- Type in the amount of transfer and the date.

- Examine and affirm the transaction.

Bill Pay

- Just proceed to the Bill Payment folder.

- Enter their details to include more payees.

- Select the payee and fill in the payment sum as well as the date.

- Identify the funding bank account.

- Verification of payment and scheduling must be done.

It is essential to recheck them to avoid errors when it comes to financial transactions

Setting Up Alerts and Notifications

The Seacomm Netteller system has a feature known as customizable alerts and notifications which keep you updated with your account status.

- Head to the “Alerts” or “Notifications” section

- Pick the types of alerts that you would like to receive (e.g., low balance alerts, large transaction alerts, login attempts alerts)

- Set thresholds or conditions for the alerts

- Select your preferred mode of notification (e-mail, text message, or push notification)

- Finally, save the settings.

Thus configuring appropriate alerts, helps one manage their accounts better and act accordingly in case of any irregularities.

Mobile Banking with Seacomm Netteller

Seacomm Netteller wants to make sure that banking is always within reach with a mobile application:

- Download the Seacomm mobile application on the app store for your device.

- Sign in using your Netteller login details.

- Include features like mobile check deposit, fingerprint or face ID login, as well as an ATM locator based on your location.

The mobile application has nearly all the functionalities offered by the desktop version, enabling you to handle your money from any location.

Security Features and Best Practices

Your victual quantities are safe by Seacomm Netteller Login:

- Two or more ways to identify yourself

- Mapping of important numbers

- For those who are inactive, automatically sign out

- Adaptive reasoning questions and responses

- Behaviors in accounts

To enhance your security:

- Netteller’s password should be easy but hard to guess.

- All operational levels of security must be utilized.

- Bank on your phone but don’t do it while connected to a public Wi-Fi.

- Conduct frequent updates to your handheld devices and computers.

- Be alert for ‘phishing’ attacks; do not disclose any of your login details.

Troubleshooting Common Login Issues

In case you experience difficulties accessing your Seacomm Netteller account, follow these recommended troubleshooting procedures:

- Verify if the username and password inputs are accurate.

- Check that the caps lock is not on.

- Clear the browser cache and cookies.

- Use another browser or device.

- Look if there are any indicated system downtime reports yet.

Seek help from Seacomm’s customer service if issues remain unresolved.

Customer Support and Resources

When you want to maximize your Netteller experience, Seacomm has several options for you:

- FAQ section available at their web portal

- Video tutorials and user manuals

- Assists live chat

- Phone support during official working hours

- Secured communication options are accessible on the Netteller platform.

If ever in doubt and questions arise on Internet banking services do not shy away from asking us for help.

Conclusion

Seacomm Netteller Login is an extremely useful device for handling your finances. Once you understand its features and make sure to follow the best security practices, you can perform your banking activities on the Internet safely and very easily. You can manage your money better by using Seacomm Netteller where you can check your balances, transfer funds, or pay bills. Seacomm Netteller helps you take charge of your financial future as it embraces online banking and hence you need to be part of this revolution.

Frequently Asked Questions (FAQ)

Q1: How do I reset my Seacomm Netteller password?

A: To reset your password:

- Navigate to Seacomm’s official homepage, then on its right side find the tab that says Seacomm Netteller Login.

- Click this and choose the “forgotten password” option that appears.

- Input your username and follow the instructions given to authenticate you.

- Lastly, create a new password according to the security guidelines provided.

Q2: Is Seacomm Netteller safe to use?

A: Absolutely, as it contains measures such as encryption and multi-factor authentication just like any other industry around us for making sure our financial data remain private even though it is important also not forget to comply with our online security rules.